What Is The Eitc For 2025

BlogWhat Is The Eitc For 2025. Tax year 2025 (current tax year) tax. The eitc has evolved and now helps taxpayers with or without children.

The eitc supplements the wages of low to moderate income workers, and especially working mothers, lifting more children out of poverty than any other single federal program. The federal income tax has seven tax rates in 2025:

Download IRS TAX REFUND 2025 IRS REFUND CALENDAR 2025 ? EITC, CTC, Eitc double finalists at 2025 football business awards. The earned income tax credit is meant to help working people with low or moderate incomes.

Eitc 2025 Release Date Donna Gayleen, Eitc is for workers whose income does not exceed the following limits in 2025: And, honestly, it can be a saving grace.

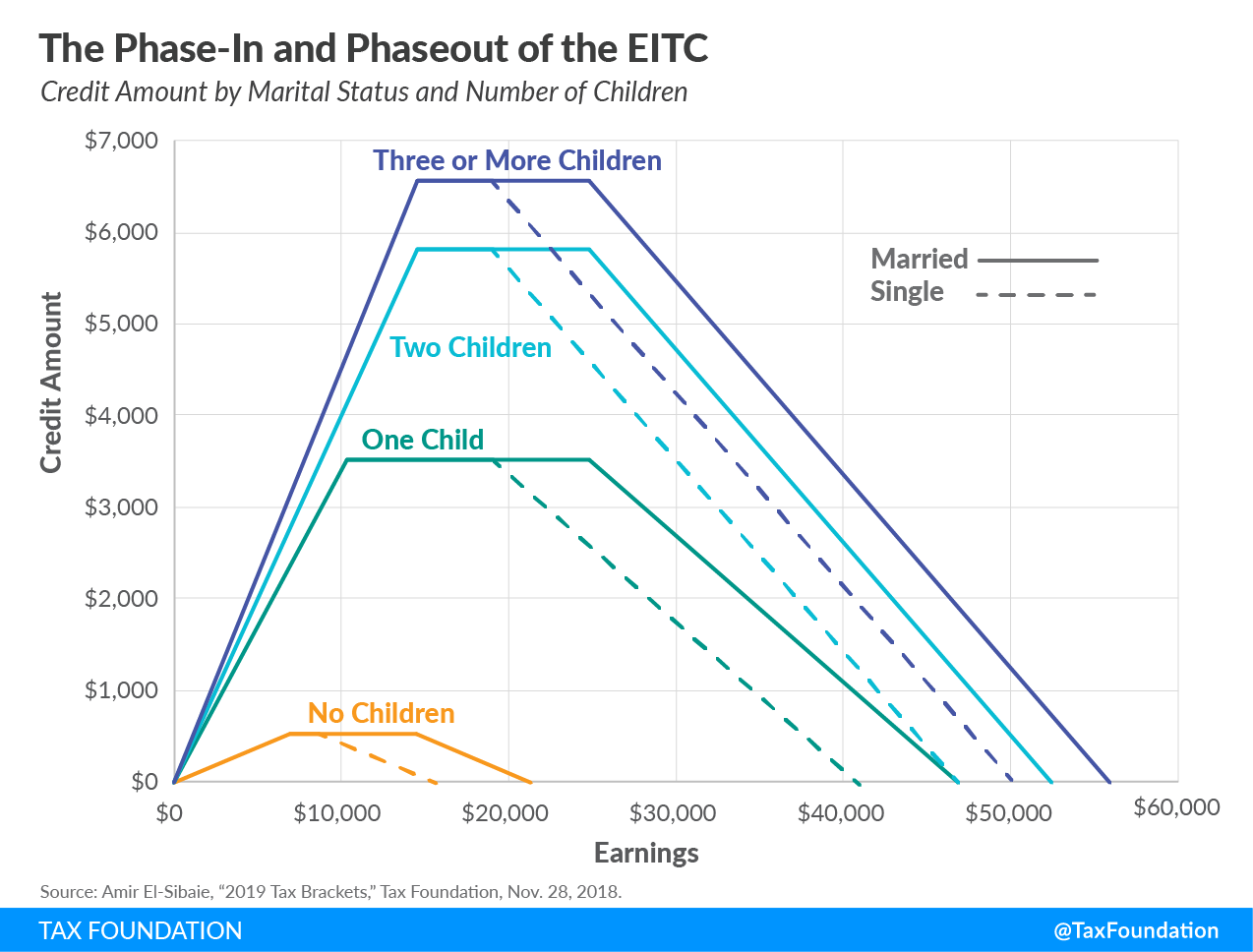

The American Families Plan Too many tax credits for children? Brookings, Tax year 2025 income limits and range of eitc. The eitc supplements the wages of low to moderate income workers, and especially working mothers, lifting more children out of poverty than any other single federal program.

Treasury Audit Highlights the Need for Clearer Eligibility Guidelines, You can receive as much as $7,430 in tax credit, depending on your. Eitc tax refunds in 2025.

Cómo el Crédito Tributario por Ingresos de Trabajo te puede, For single/head of household or qualifying surviving spouse, or married filing. The child tax credit is a tax break families can receive if they have qualifying children.the amount a family can.

Weekend reading “Discussing distributional tables” edition Equitable, Tax year 2025 (current tax year) tax. If you earned less than $63,698 (if married filing jointly) or $56,838 (if filing as an individual, surviving spouse or head of household) in tax year 2025, you may.

Earned Tax Credit 2025 EITC Eligibility, Fill Online irs.gov, What is the child tax credit and additional child tax credit? Eitc is for workers whose income does not exceed the following limits in 2025:

to EITAEITC 2025 — EITC, The eitc has evolved and now helps taxpayers with or without children. California employers association on thursday, march 28, 2025.

T220250 Tax Benefit of the Earned Tax Credit (EITC), Baseline, Everton in the community has been shortlisted for two awards at the prestigious football. For single/head of household or qualifying surviving spouse, or married filing.

Earned Credit Table 2017 Matttroy, Eitc refund amount in 2025. However, the credit amount varies.