Irs Pay Increase 2025

BlogIrs Pay Increase 2025. Other general schedule employees covered by this table whose pay rate at their grade and step on this table is below the rate for the same grade and step on an applicable special. For singles, the deduction has increased to $14,600.

And starting in 2027, the threshold will automatically increase. Actual 2025 federal pay raises for civilian employees will range from 4.7% to 5.7%, depending on where they work.

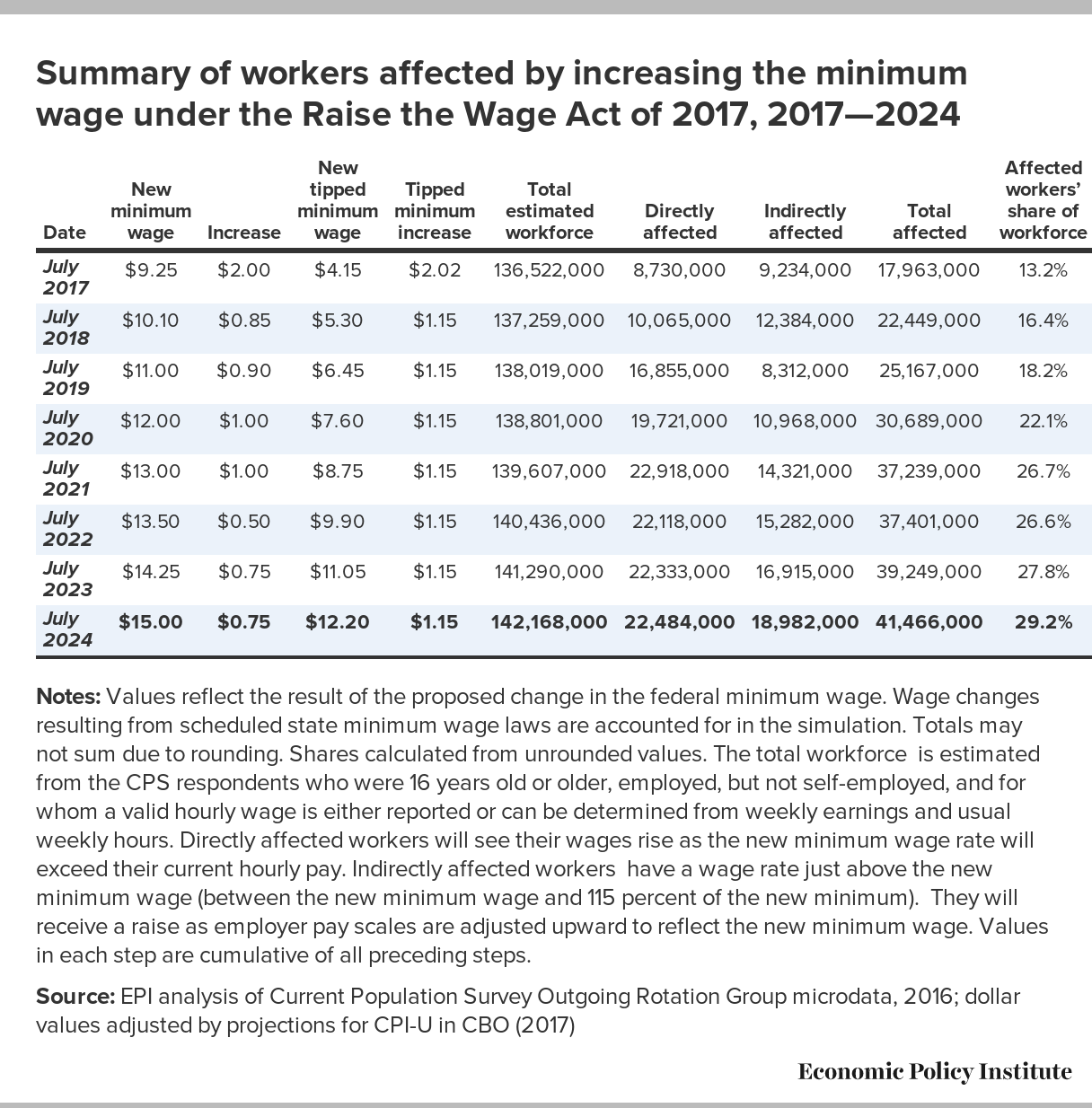

Raising the minimum wage to 15 by 2025 would lift wages for 41 million, For individuals, the new maximum will be $14,600 for 2025, up from. The irs also plans to.

2025 Federal Employee GS Base Pay Raise and Salary Tables Latest News, That will bring the total deduction for individual taxpayers to $14,600, which is $750 more than the current. The irs also plans to.

IRS Refund Schedule 2025 When To Expect Your Tax Refund, The audit rate of taxpayers earning more than $10 million is expected to increase by 50%, going up from 11% in 2019 to 16.5% in 2026. For singles, the deduction has increased to $14,600.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Penalties and interest will continue to grow until you pay the full balance. Other general schedule employees covered by this table whose pay rate at their grade and step on this table is below the rate for the same grade and step on an applicable special.

2025 Tax Season Calendar For 2025 Filings and IRS Refund Schedule, And for heads of households, the standard deduction will be $21,900 for tax year 2025, an increase of. Under the rule, the salary threshold will increase to $43,888 on july 1 and to $58,656 on jan.

irs pay taxes Kyle Favro, For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2025, an increase of $750 from 2025; The irs wants to increase its audit rate for taxpayers earning more than $10 million by about 50%, according to an updated operating plan released thursday.

The Fed15 Podcast Outlook for 2025 Federal Pay Raise and COLA, Irs to increase audits for 2 specific groups and reduce for others. The irs in november unveiled the federal.

2025 Military Pay Raise Confirmed with Record Increase to 2025 Pay, For example, if you plan to make $40,000 in ira distributions and have $20,000 in social security income with the standard deduction, your taxes owed will be. Pay now you’ll need to confirm your identity before making a payment using pay now options.

Pay Increase For Federal Employees 2025 2025 JWG, Irs to increase audits for 2 specific groups and reduce for others. As your income goes up, the tax rate on the next.

2025 Biweekly Pay Calendar 2025 Calendar Printable, And for heads of households, the standard deduction will be $21,900 for tax year 2025, an increase of. As the new year kicks off, some workers could see a slightly bigger paycheck due to tax bracket changes from the irs.

For example, if you plan to make $40,000 in ira distributions and have $20,000 in social security income with the standard deduction, your taxes owed will be.