Do I Qualify For Eitc 2025

BlogDo I Qualify For Eitc 2025. See the earned income and adjusted gross income (agi) limits, maximum credit for the current year,. To qualify for the eitc for the 2025 tax year, your birthday must be between.

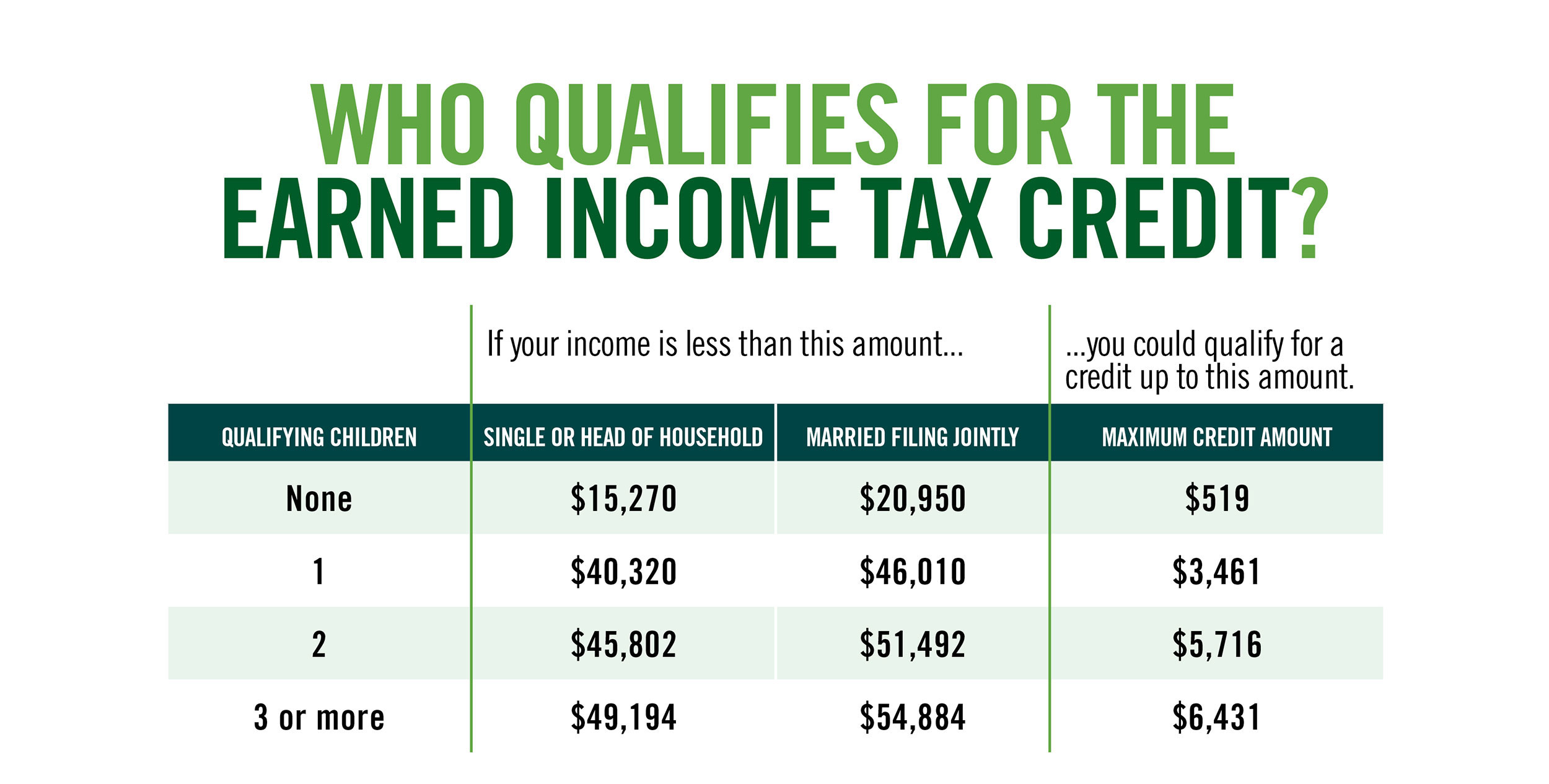

Individuals who can claim the earned income tax credit (eitc) include those filing as single, married tax filing jointly, head of household, or as a qualifying widow (er). The earned income tax credit can save you money if you qualify the earned.

Comments on 'What is the Earned Tax Credit (EITC), and do I, If you claim the eitc, your refund may be delayed. Eic and ctc refund date.

Do I Qualify for the Earned Tax Credit (EITC)? R&G Brenner, The earned income tax credit can save you money if you qualify the earned. In order to qualify for the eitc, you’ll need to meet certain rules.

Earned Credit Requirements Infographic H&R Block Budget, You can use this eic calculator to calculate your earned income. To claim the earned income tax credit (eitc), you must have what qualifies as earned income and meet certain adjusted gross income (agi) and credit.

EITC See how much you may qualify for YouTube, Use the earned income tax credit calculator from the irs to see if you qualify for the eitc. The eitc allows taxpayers to keep more of their.

T150154 Extend ATRA Earned Tax Credit (EITC) Provisions, by, If you earned less than $63,398 (if married filing jointly) or $56,838 (if filing as an individual, surviving spouse or head of household) in tax year 2025, you may. To claim the earned income tax credit (eitc), you must have what qualifies as earned income and meet certain adjusted.

Fewer Americans will qualify for this overlooked, but valuable tax credit, Here’s how to learn if you’re eligible to take the credit on your 2025 tax return, due april 15, 2025. See the earned income and adjusted gross income (agi) limits, maximum credit for the current year,.

What is the Earned Tax Credit and Do You Qualify For It? YouTube, To claim the earned income tax credit (eitc), you must qualify and file a federal tax return. Use the earned income tax credit calculator from the irs to see if you qualify for the eitc.

Minimum To File Taxes 2025 In Illinois Vin Quinta, To qualify for the eitc for the 2025 tax year, your birthday must be between. To claim the earned income tax credit (eitc), you must have what qualifies as earned income and meet certain adjusted.

Do I Qualify for Earned Tax Credit EITC Internal Revenue, To claim your 2025 eitc, you must file a 2025 tax return by april 18, 2025. The following table provides a.

What Is Earned Tax Credit (EITC) And How To Qualify For It?, If you filed a 2025 tax return but didn’t get the eitc and were eligible for it, you can amend your tax. When do eitc refunds go out 2025.

Individuals who can claim the earned income tax credit (eitc) include those filing as single, married tax filing jointly, head of household, or as a qualifying widow (er).